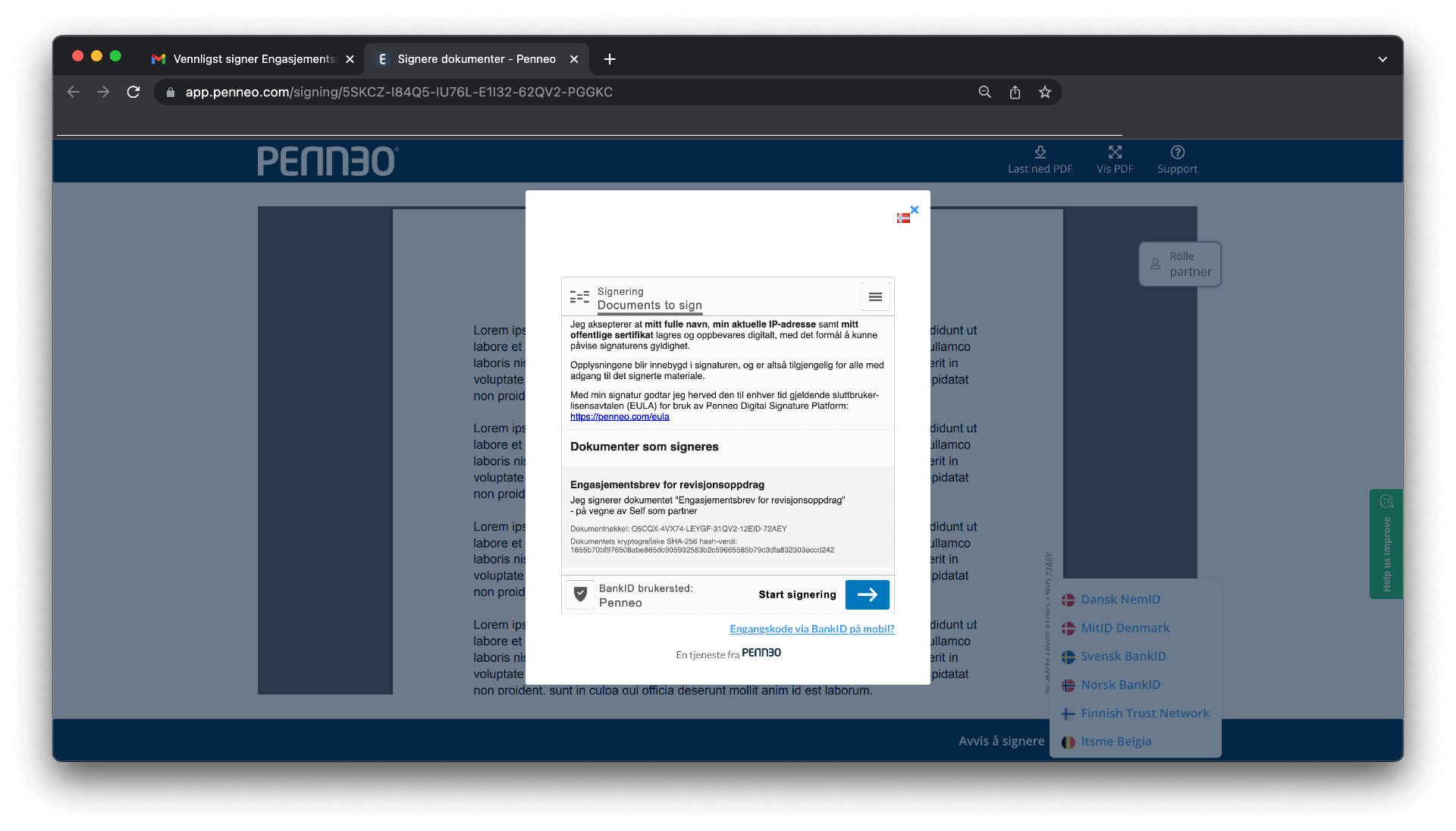

BankID is a Norwegian electronic ID that enables people to prove their identities and sign documents online. All digital signatures created with BankID meet the eIDAS requirements for advanced electronic signatures and are legally binding.

What are the benefits of signing documents online?

Did you know that more than 450 Norwegian companies use Penneo to sign documents online? This is because electronic signatures help businesses improve efficiency, cut costs, and deliver a more modern customer experience.

Let’s take a closer look at the many advantages of digital signatures and see how they can benefit your organization.

Documents signed with BankID are legally binding

When you sign a document using your BankID, you create an advanced electronic signature that is able to identify the signer and detect any subsequent changes to the signed document. Therefore, a digital signature created with BankID is legally binding and can be used as evidence in court.

In Norway, you can sign most types of documents with BankID. However, there are still a few situations where the law requires a handwritten signature.

Signing with BankID improves efficiency

Collecting signatures from multiple signers in a particular order can take a very long time. It involves printing, scanning, and mailing the document back and forth. Sometimes the processes can take days or even weeks. Digital signatures can help you streamline your signing processes and get documents signed in just a few hours.

50% of all the documents sent out by Norwegian companies via Penneo Sign are signed by all parties in less than 5 hours. And thanks to our automation features and integrations with other software, you can eliminate manual work, minimize errors, and focus on the tasks that bring you closer to achieving your business goals.

Your clients can sign the documents at their own convenience

Nowadays, convenience plays a crucial role in the success of every business. Clients expect to be able to sign documents digitally with their BankID since it is much easier and quicker than meeting up in person to sign.

Therefore, not offering your clients the option to sign with BankID is often a deal breaker and can negatively impact your bottom line.

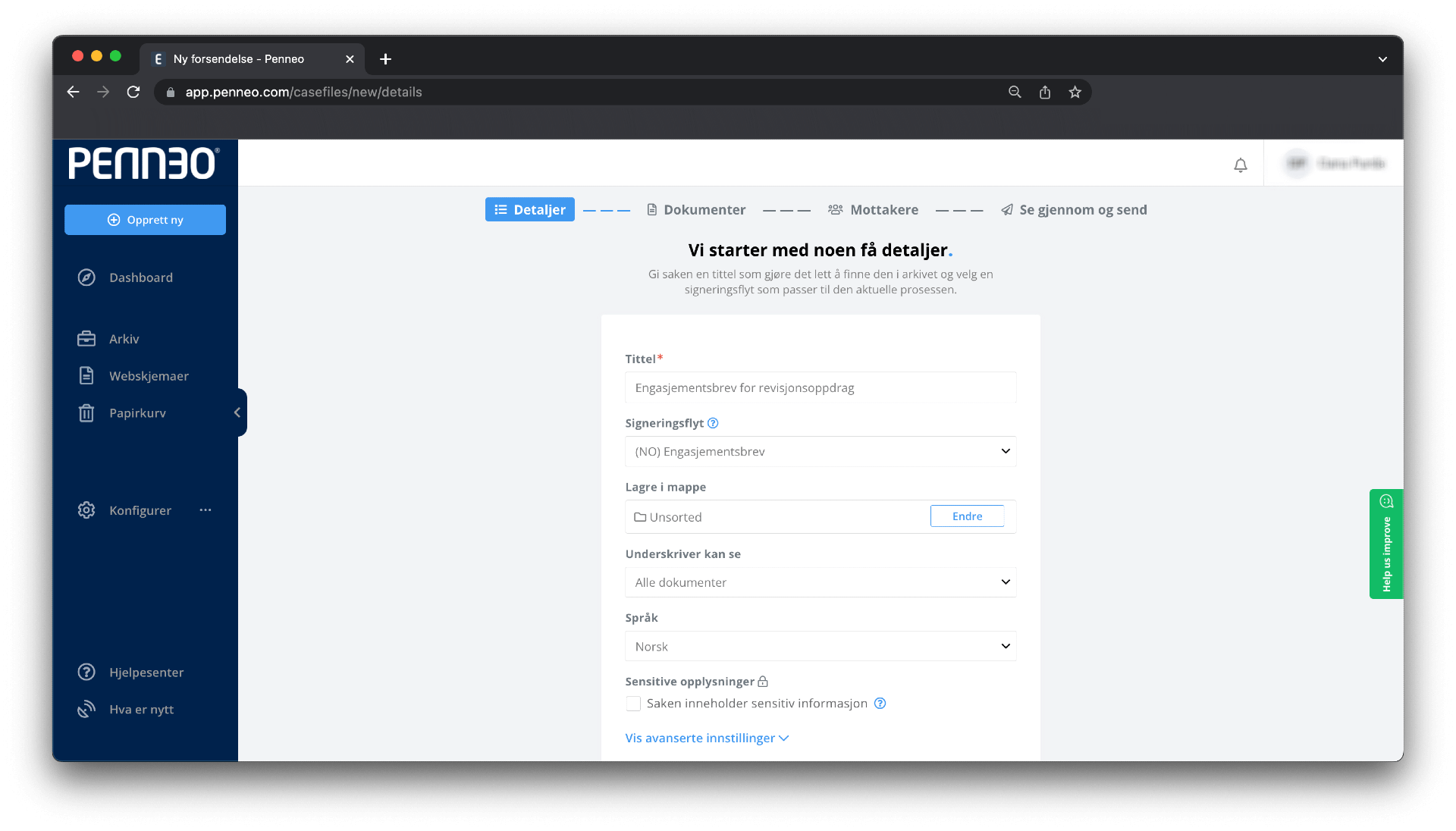

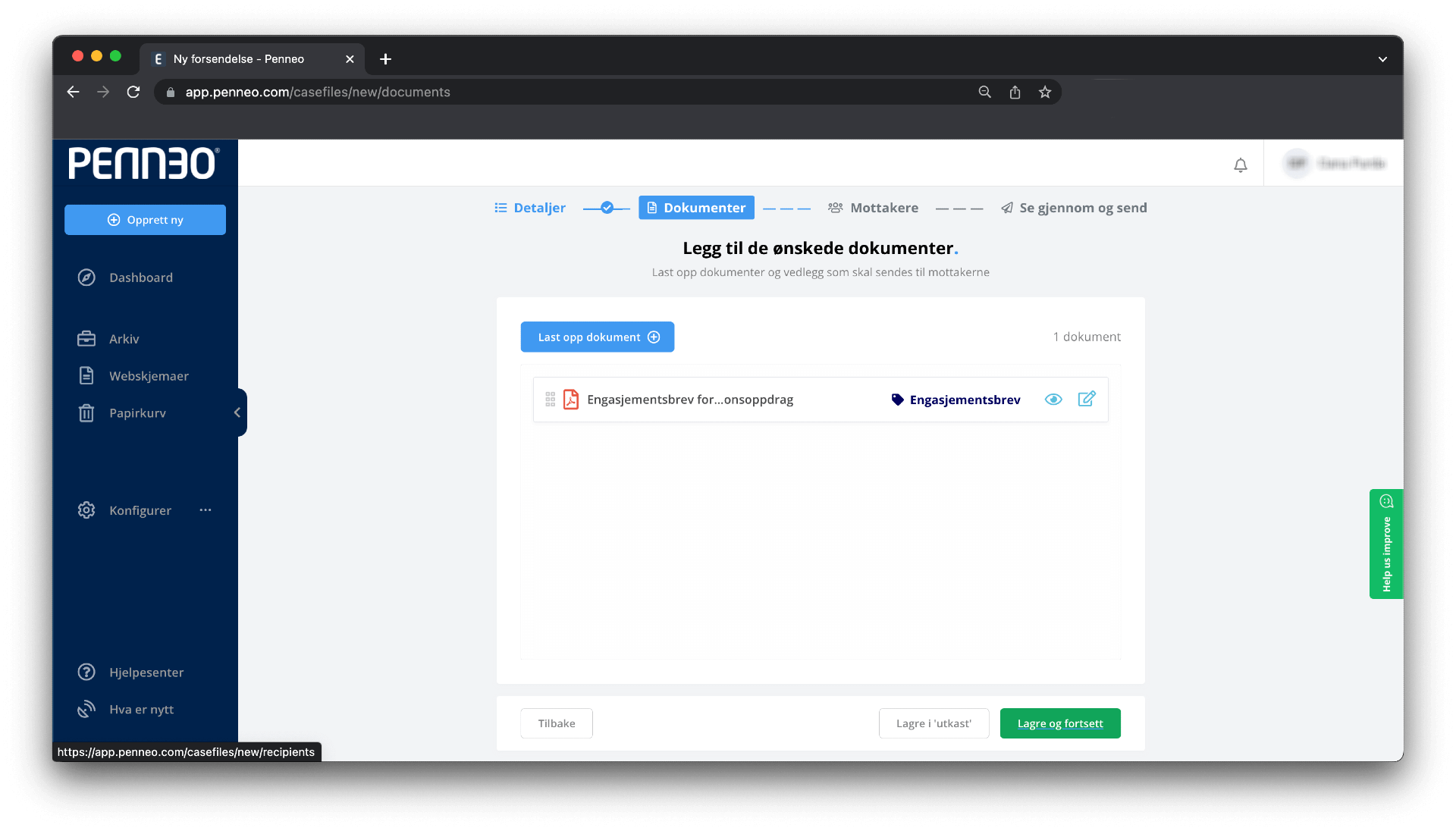

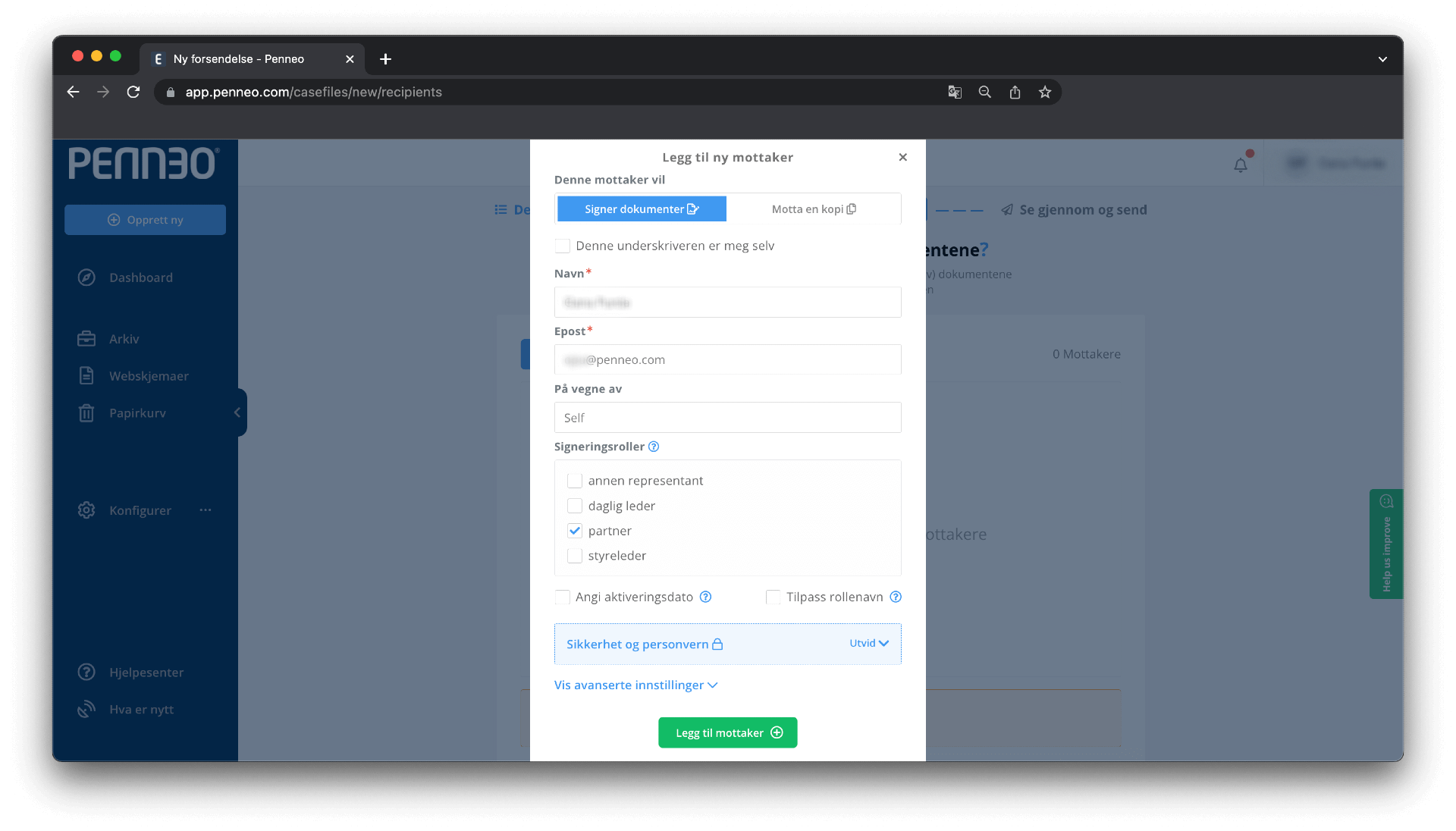

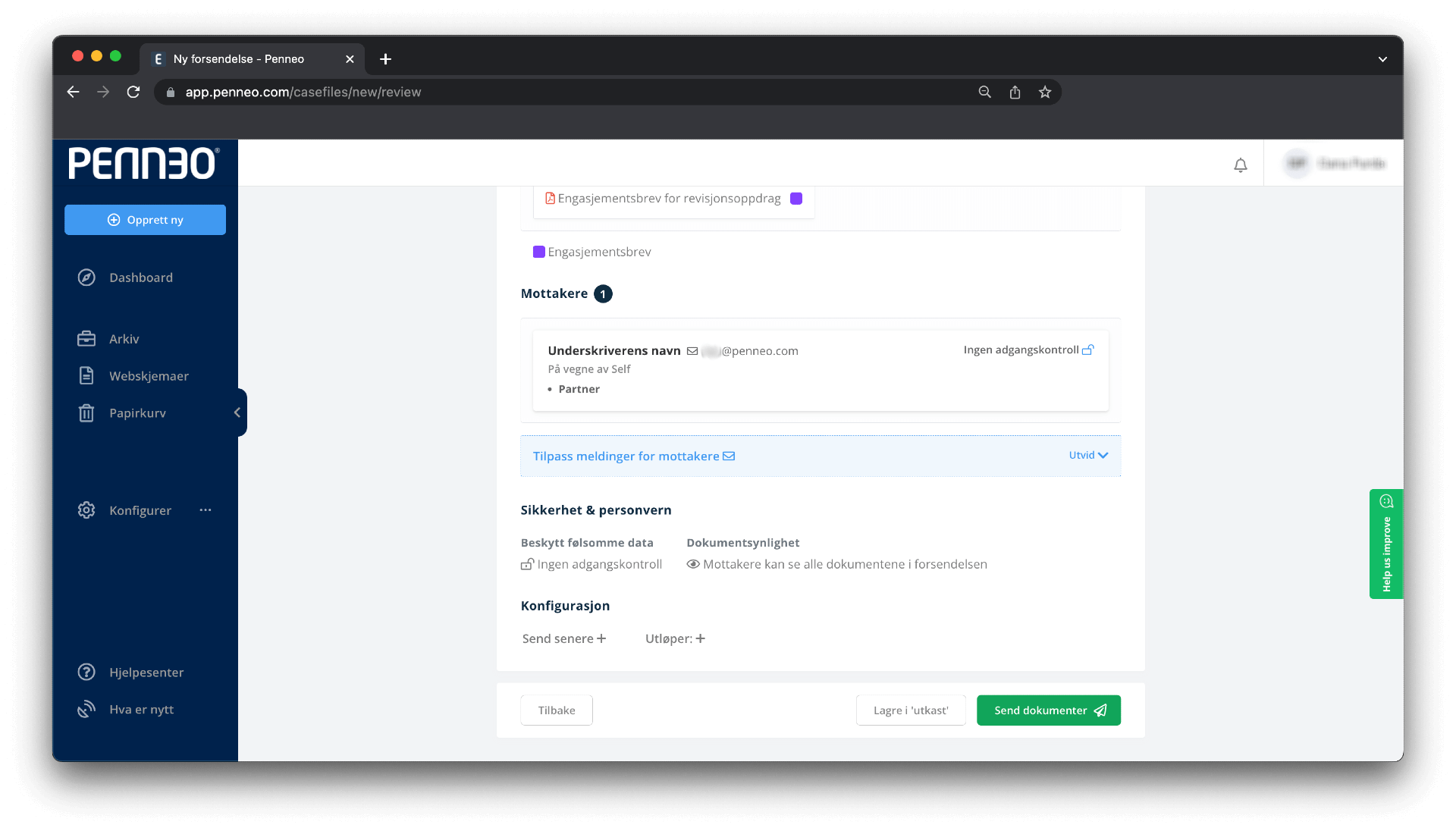

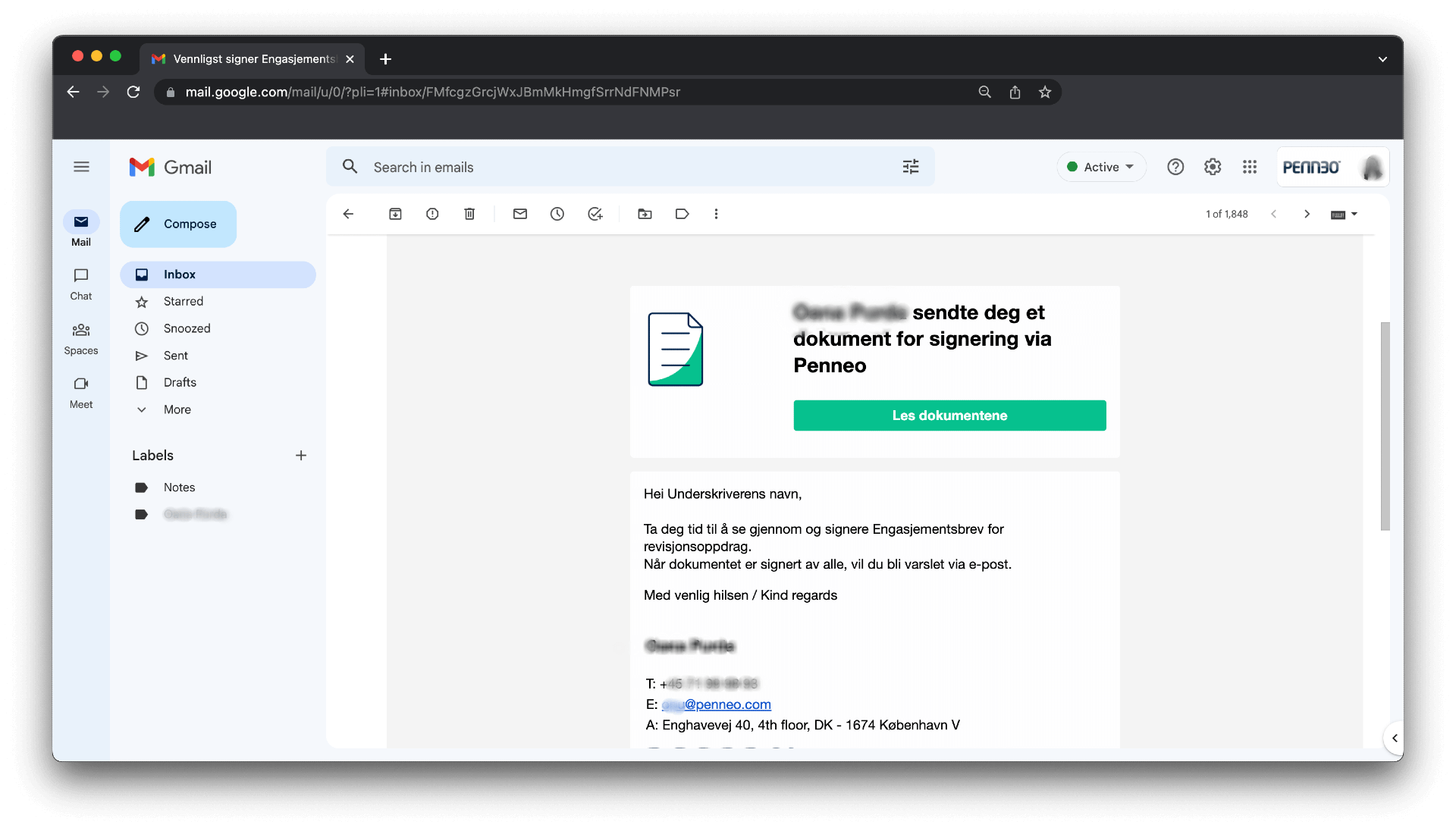

How do I send a document for signature via Penneo Sign?

To send a document out for signature via Penneo Sign, simply follow the steps below.

It was very easy and quick to get started with Penneo. And it’s been an easy solution to learn how to use too. It’s helped us collect signatures and complete some processes much faster.

– Barbro H. Johansen, Head of Digital Innovation and IT at Advokatfirmaet Haavind

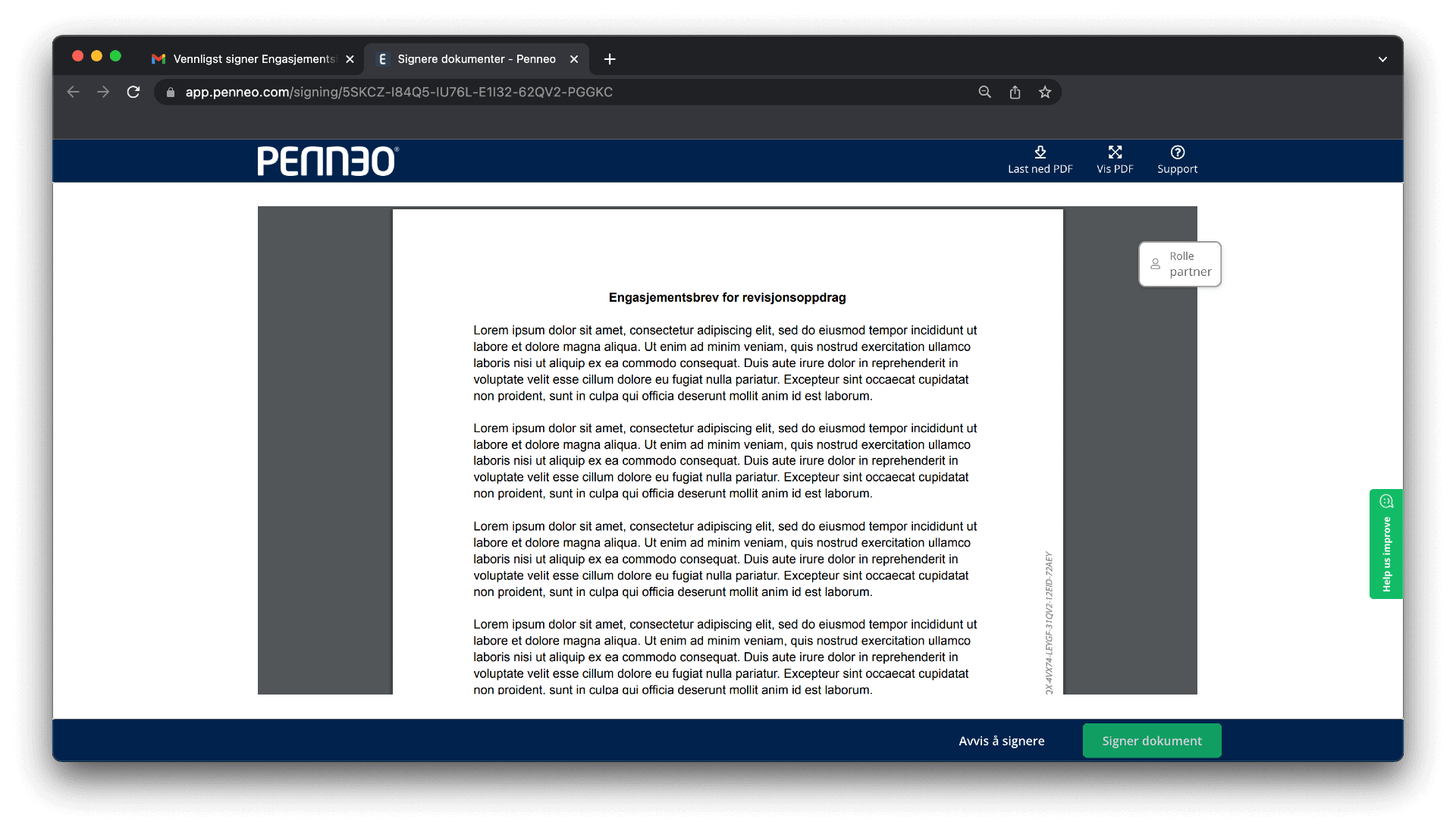

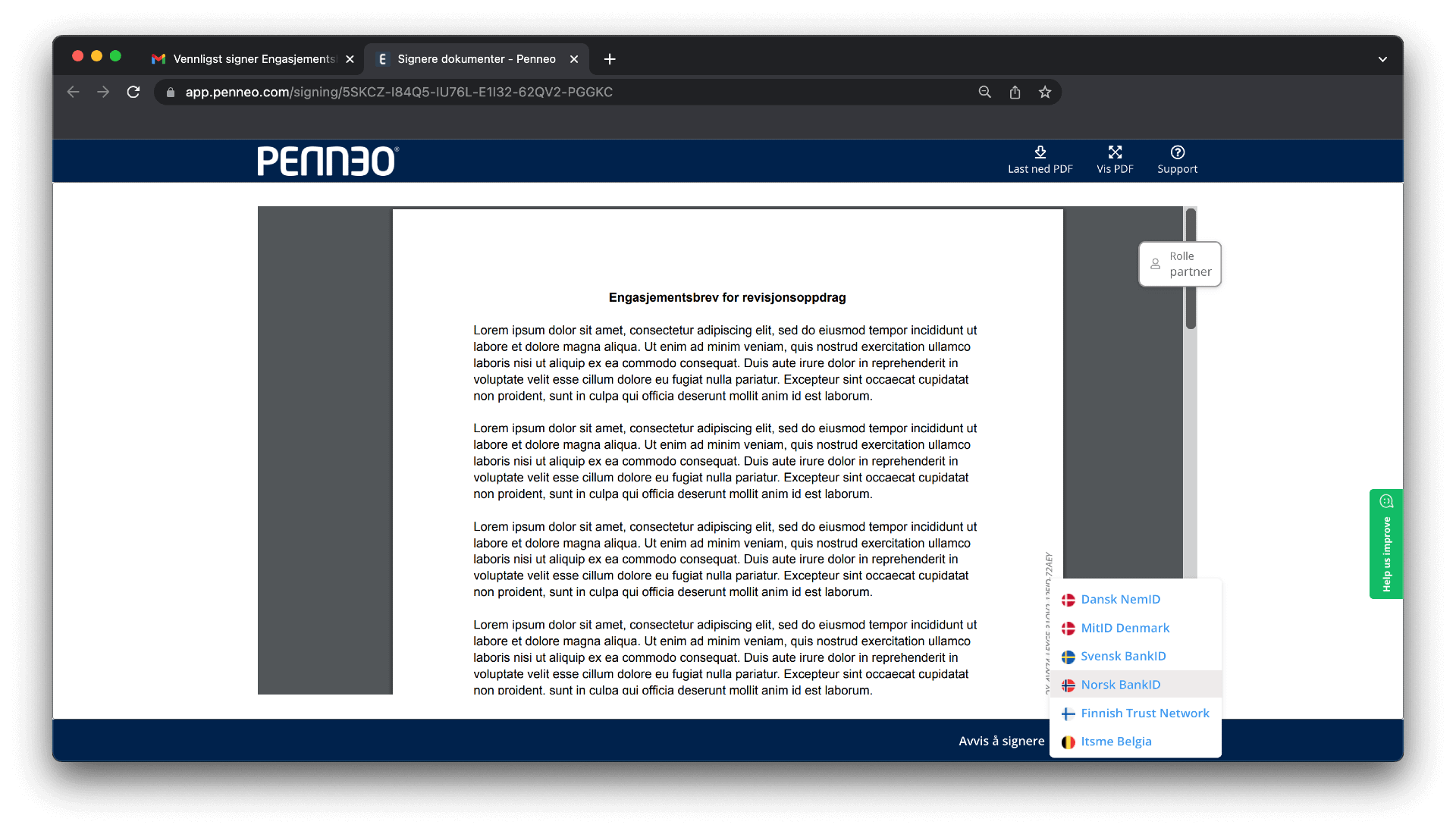

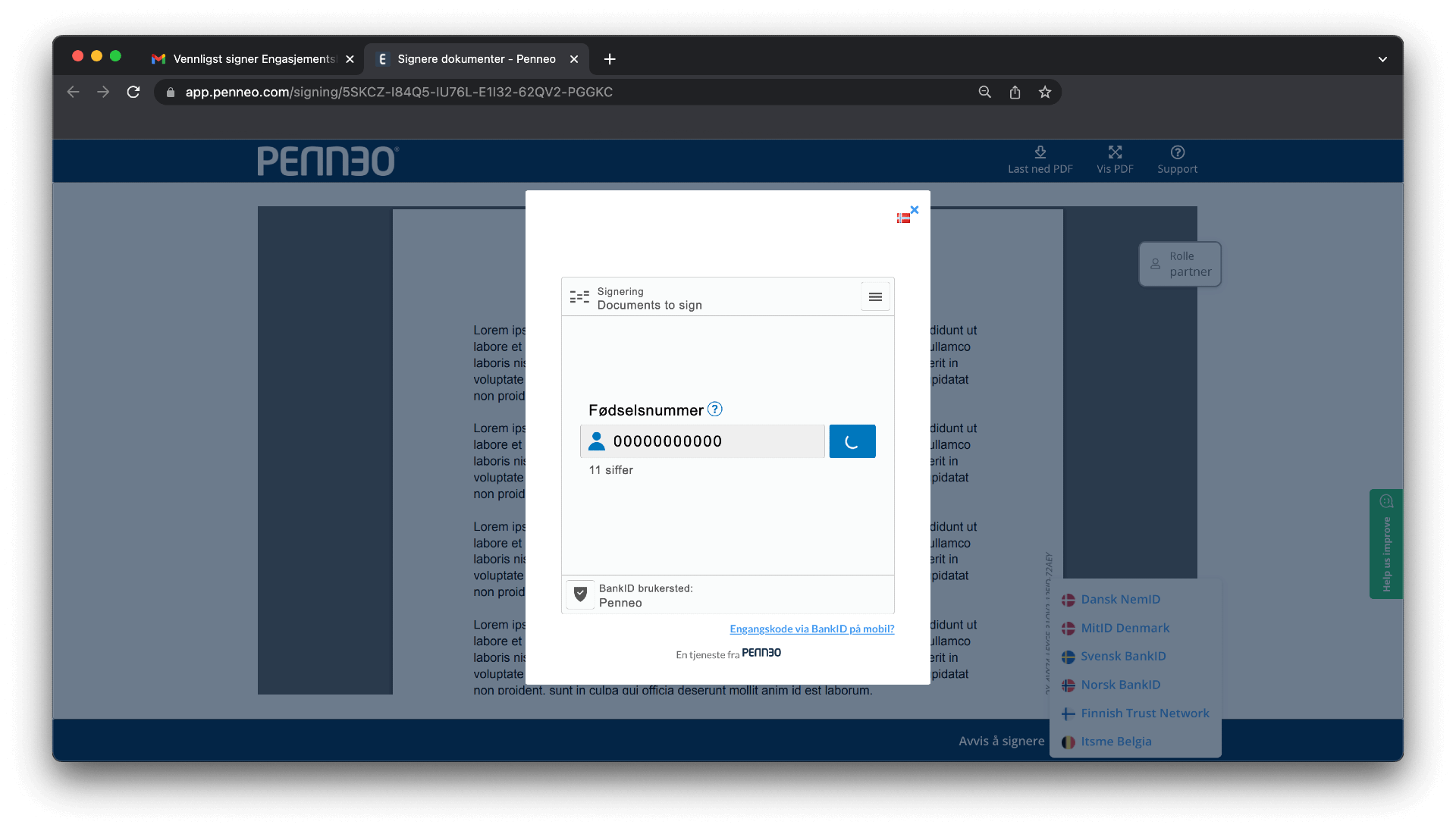

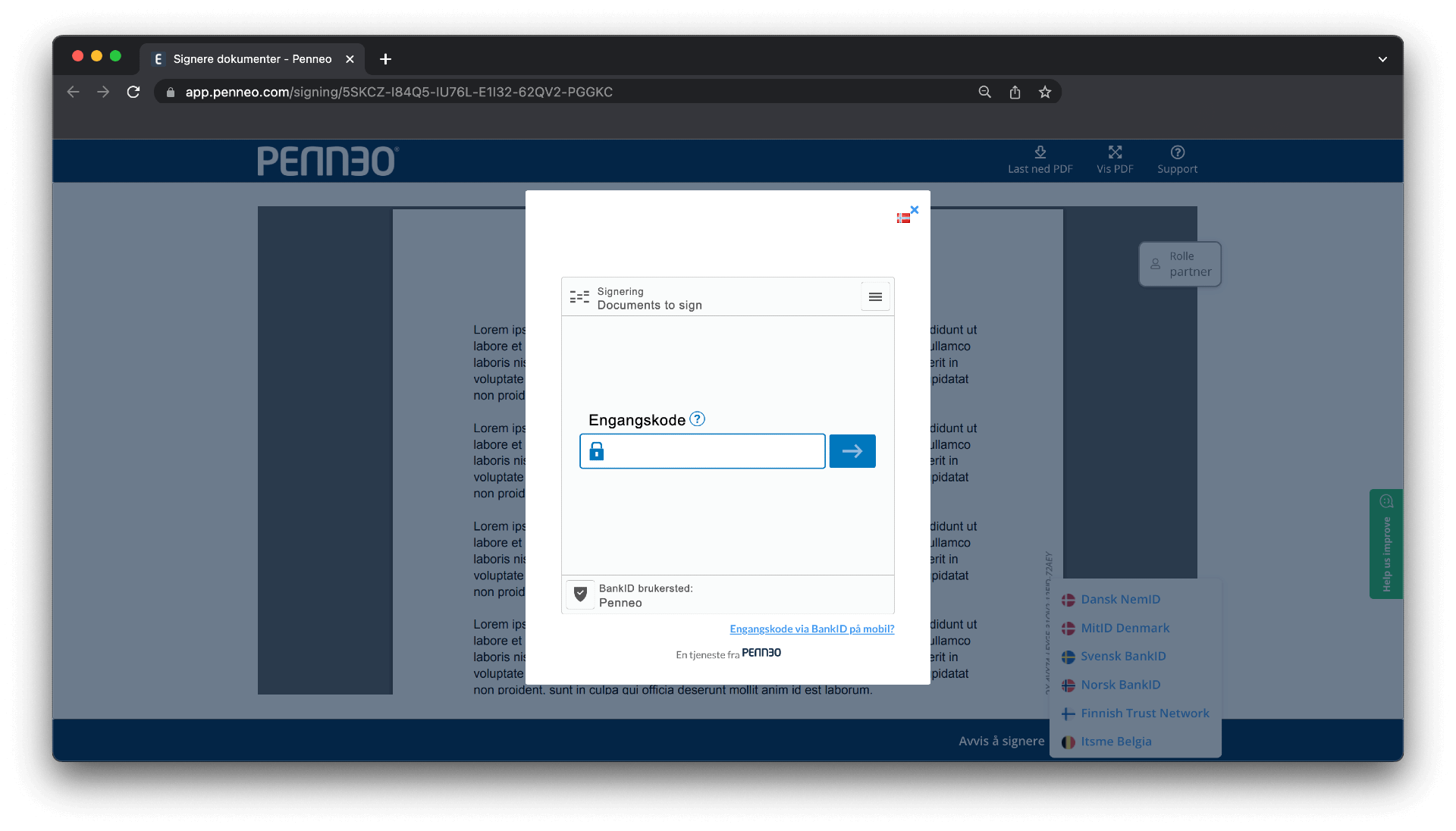

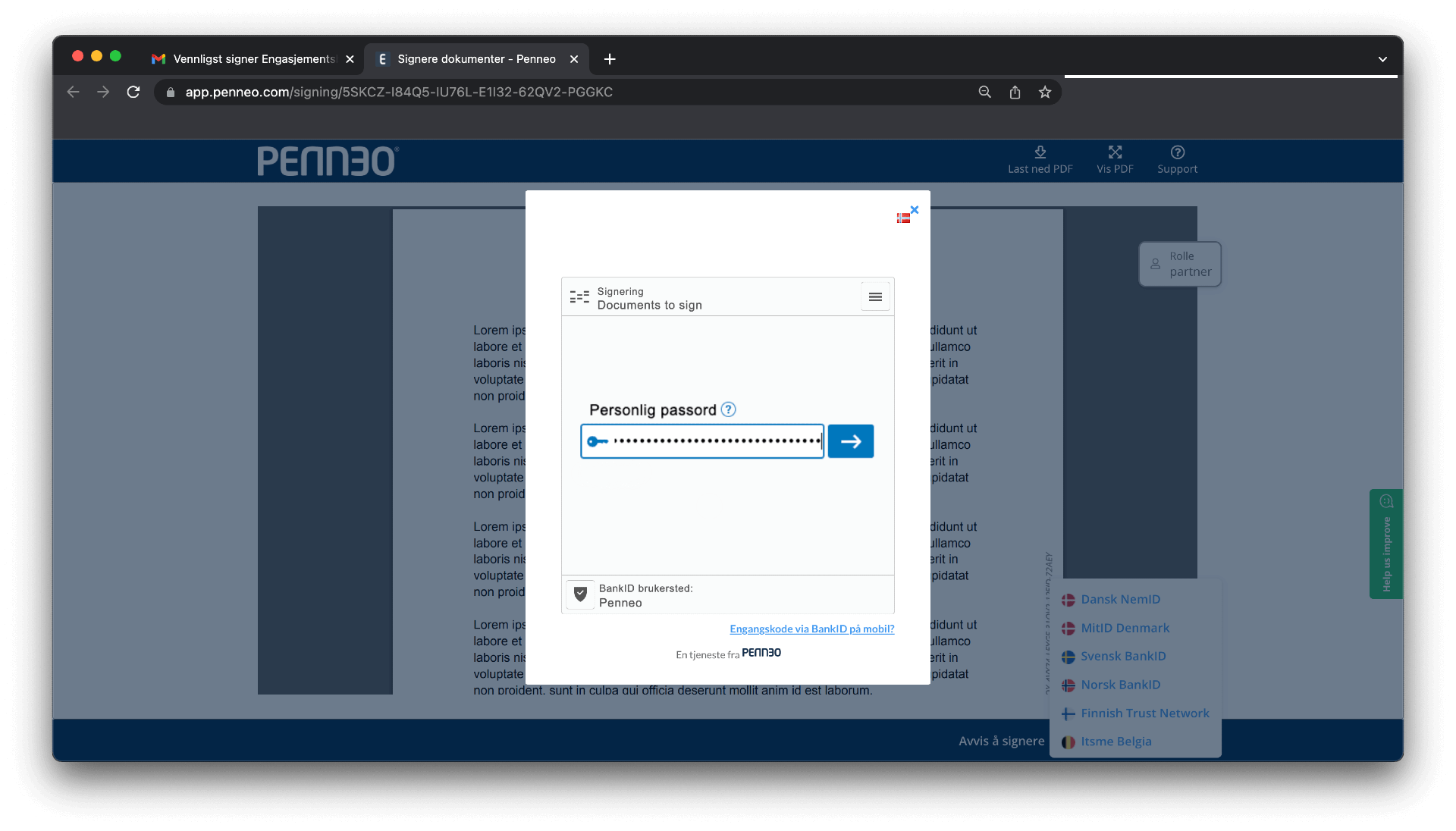

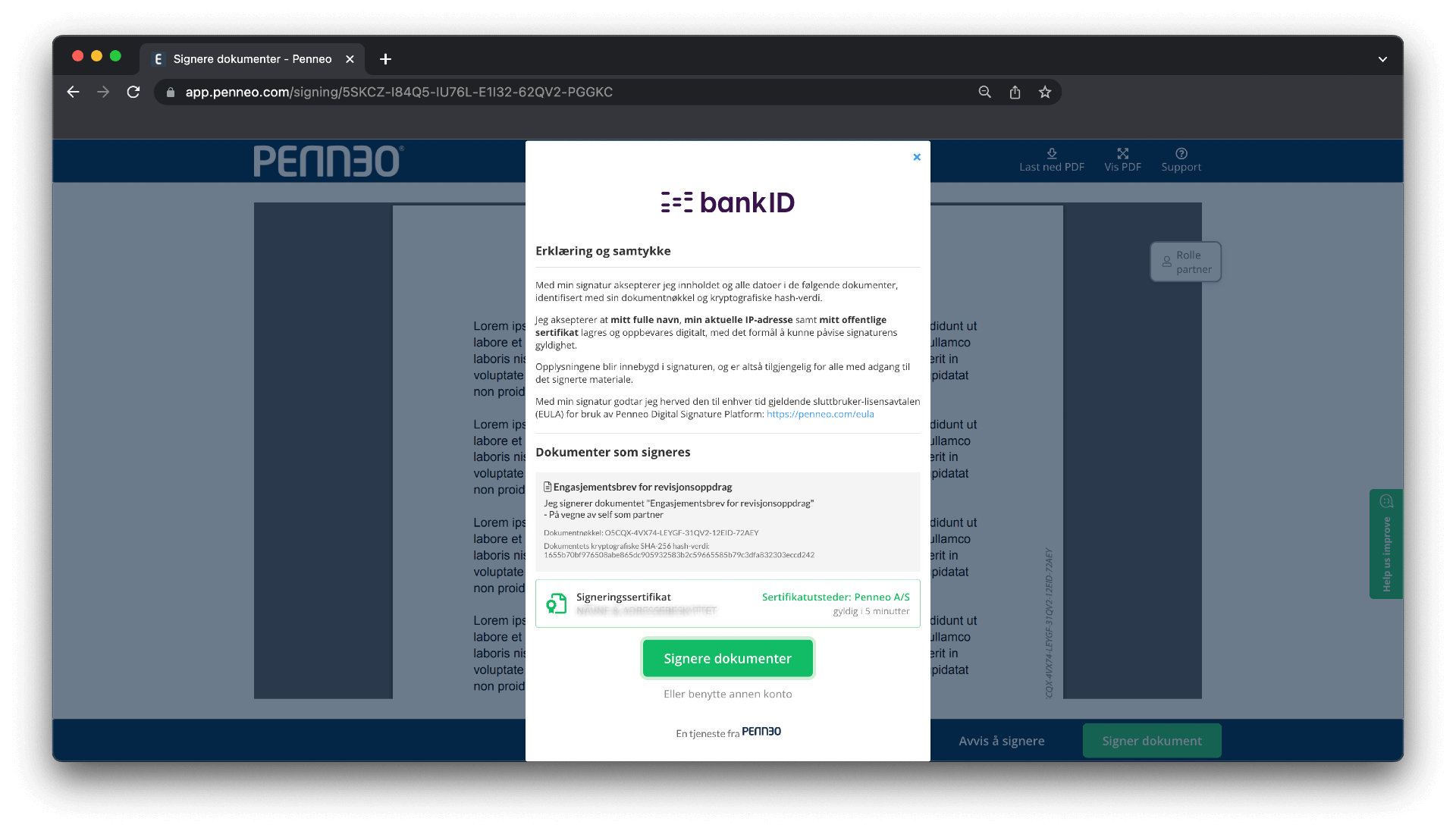

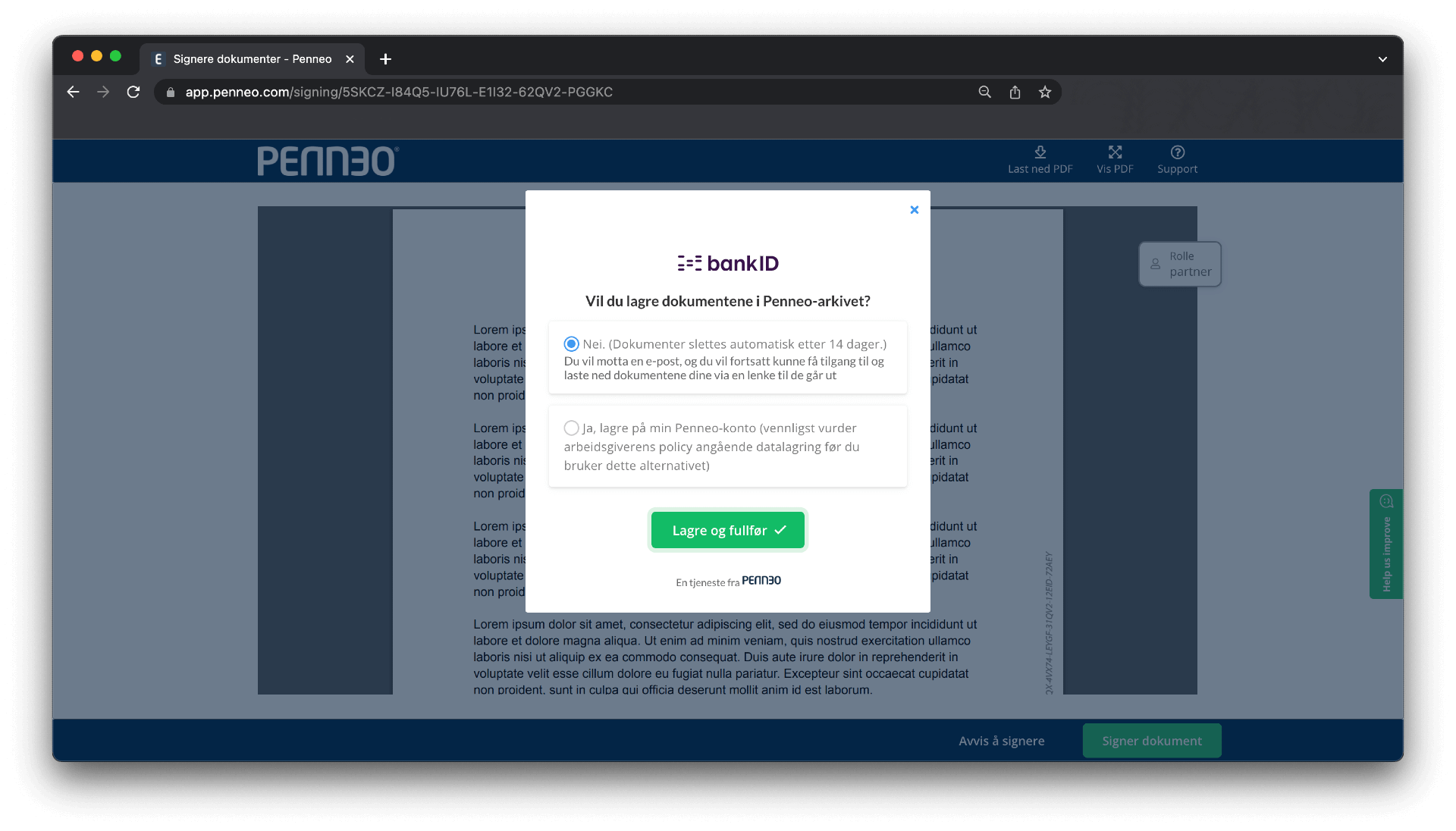

How do I sign a document with BankID via Penneo Sign?

To sign a document with BankID via Penneo Sign, you have to follow the steps below.

Previously, it could be time-consuming for our clients to sign documents. But with BankID being well-known in Norway there’s less hassle for our clients when they have to sign via Penneo, as they’re already used to BankID.

– Barbro H. Johansen, Head of Digital Innovation and IT at Advokatfirmaet Haavind

Sign documents online with BankID via Penneo Sign

Penneo Sign is one of the leading digital signature platforms in the Nordics. Over 2600 companies use Penneo Sign to automate their signature processes, provide a better customer experience, and ensure compliance with the eIDAS regulation and the GDPR.

With Penneo Sign, you get more than just BankID signatures. You get a solution that automates your signing workflows from A to Z. Here’s how.

- API and prebuilt integrations: Reduce manual work by using Penneo Sign together with your existing software.

- Automated document routing: Take advantage of our automation capabilities to ensure your documents get signed by the right people in the right order.

- Automated reminders: Schedule automated email reminders to ensure that everyone remembers to sign.

- Audit log: The audit log records all the steps of the signature process for business continuity and transparency.

- Dashboard: View the status of your documents — pending, completed, or rejected.

- Secure data storage: All data stored in Penneo Sign is encrypted and can only be accessed by authorized people.

- PDF forms: Create fillable PDF forms and collect customer and employee data securely. The recipient can sign the form with BankID after filling it in.

- Support for various digital IDs: With Penneo Sign, you can sign with a variety of eIDs such as itsme®, Swedish BankID, MitID, Finnish BankIDs, and Mobiilivarmenne.

- Bulk signing: Penneo Sign allows you and your clients to sign multiple documents with just one signature.

- Access control: Make sure that only the right people can view and sign sensitive documents by enabling eID authentication.

Request a free trial of Penneo Sign and start signing documents online with BankID today!