Penneo KYC

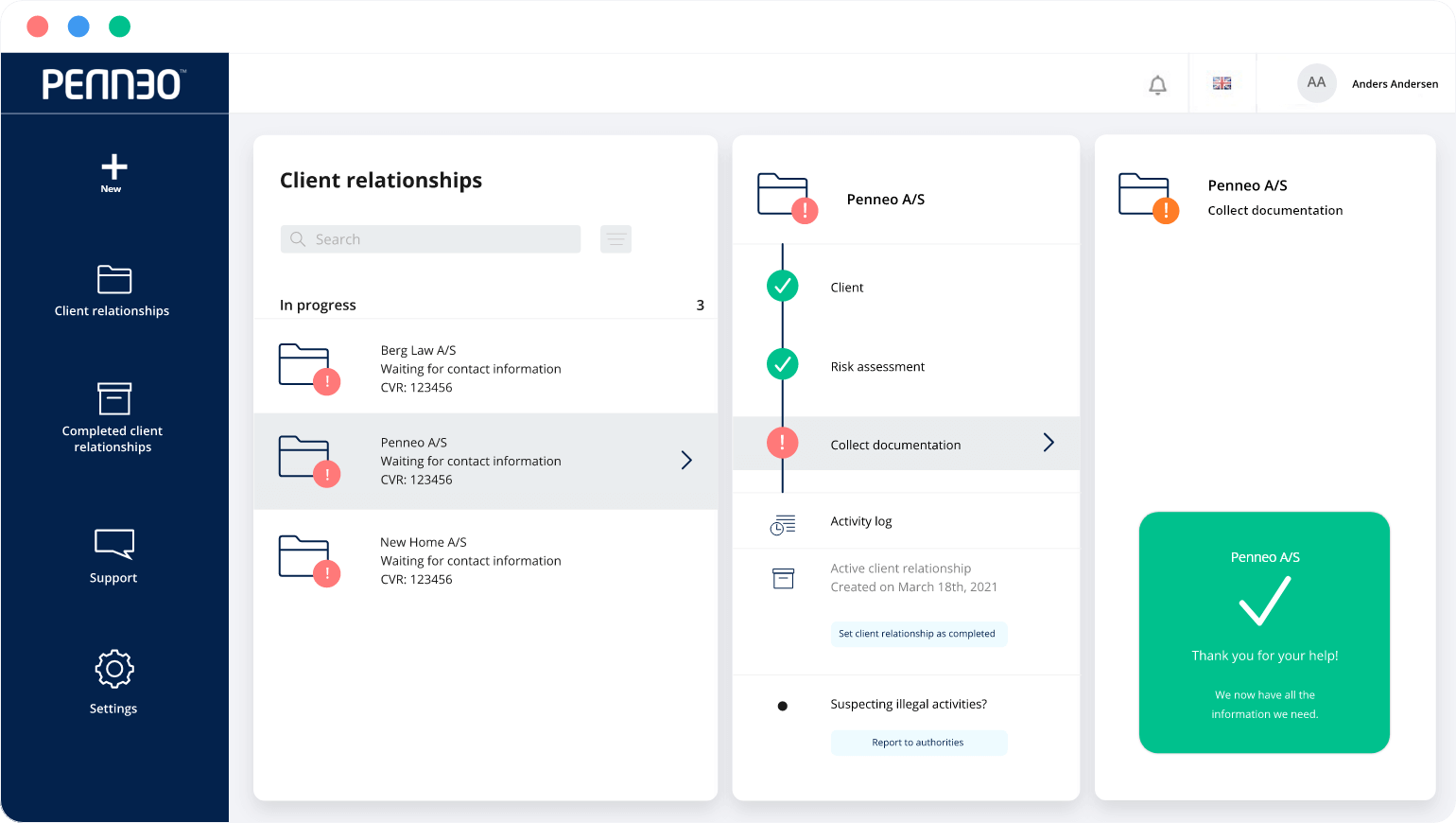

Penneo KYC helps companies meet their anti-money laundering obligations in a more efficient way.

The system automates the entire KYC process — from customer due diligence and client risk assessment to continuous monitoring of the business relationship and screening of customers and beneficial owners against PEP and sanctions lists.

How can Penneo KYC help companies that are subject to Anti-Money Laundering laws?

Penneo KYC can help companies that are covered by AML laws to cut down costs, save time, and improve the client experience by automating time-consuming and inefficient KYC processes.

KYC and client risk assessments

Customer due diligence made easy

Professional & secure customer experience

AML compliant in minutes

Effortless, secure, and compliant KYC processes

FAQ

- auditors, accountants, and tax advisors

- credit and financial institutions

- real estate agents

- notaries and other independent legal professionals

- trust or company service providers

- gambling service providers

- other persons trading in good valued over €10.000

Even if your firm is not required to comply with AML laws, KYC is rapidly becoming the norm for all industries as it’s always a good idea to ensure you’re doing business with trusted entities.

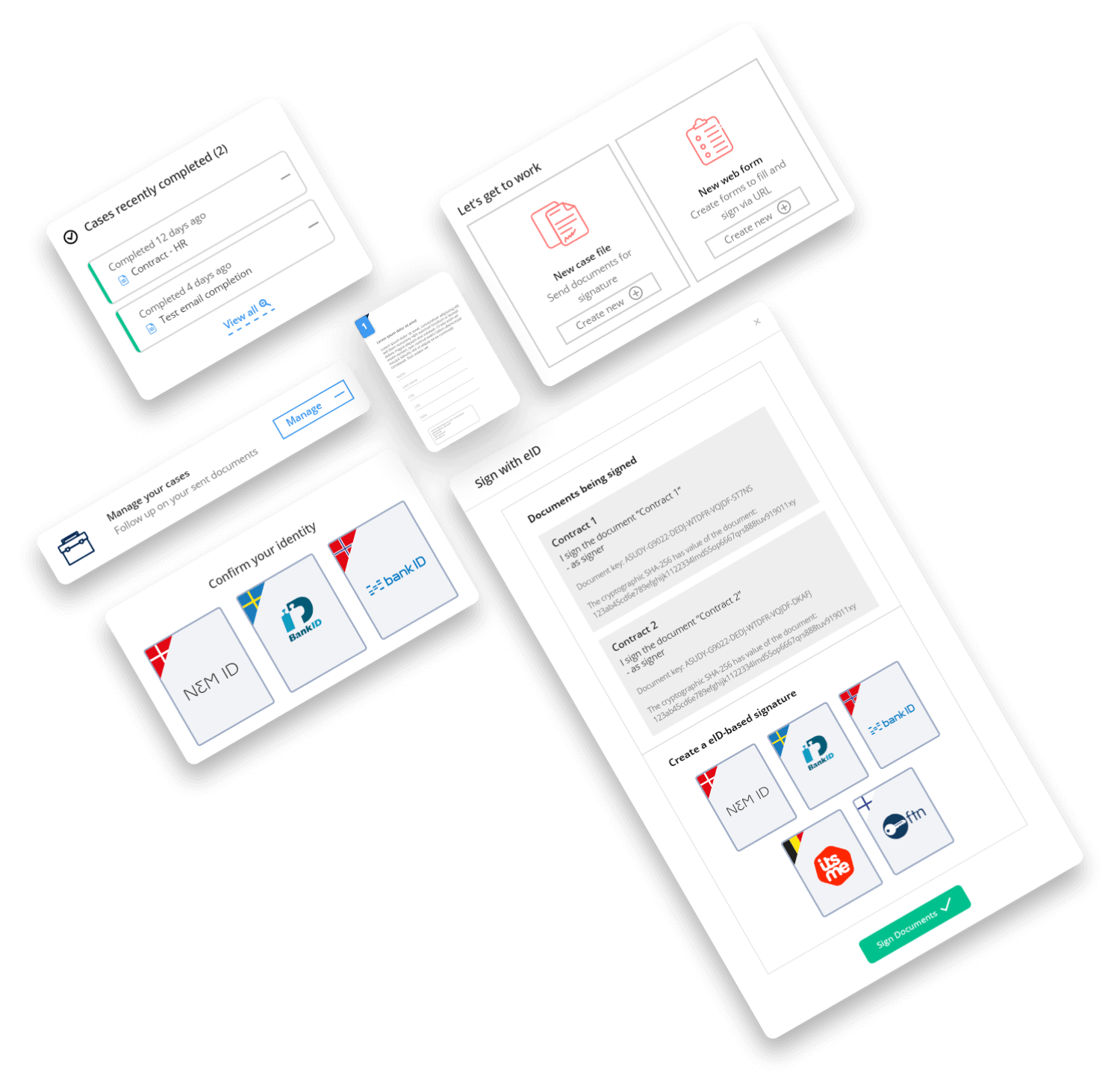

When you start a new business relationship, you need to collect:

- information on the identity of the customer and beneficial owners (name, address, etc.)

- information on the purpose and intended nature of the business relationship (source of income, frequency of transactions, etc.)

- additional information needed to rate the risk level of the customer (type of business, geographic location etc.)

You can read more about the data collection and Customer Due Diligence (CDD) process here.

Yes! Penneo is built with safety and compliance in mind to provide you with an easy way to meet all AML requirements. Hundreds of security-conscious customers already use it on a daily basis to onboard clients digitally and document their compliance efforts.

You can find a complete overview of all the requirements needed to comply with Anti-Money Laundering laws here.

Discover the benefits for your industry

Learn more about Anti-Money Laundering and Know-Your-Customer

KYC stands for Know Your Customer and is the process of verifying the identity...

Customer due diligence, aka CDD, plays a crucial part in ensuring compliance with Anti-Money...

The EU’s legal framework on anti-money laundering and countering the financing of terrorism (AML/CFT)...