RegTech solutions have been revolutionizing the way that organizations perform KYC verification. The move to digital KYC processes translates into reduced compliance costs, significant time savings, and a better client experience.

In this article, we highlight the key benefits of digital KYC and show you how your business can harness technology to streamline KYC processes, demonstrate AML compliance, and ensure the protection of client data.

What is digital KYC?

Digital KYC is the process of verifying the identity of your clients and assessing their risk level with the help of digital tools, such as Penneo KYC.

Digital KYC solutions enable organizations to automate sanctions & PEP checks, data collection, and beneficial owner identification, thus making the KYC verification process far more efficient.

Why are obliged entities shifting to digital KYC?

Banks, law firms, auditors, accountants, real estate companies, and other obliged entities are shifting to digital KYC to improve efficiency, strengthen compliance, and provide a more convenient experience to clients.

Increased efficiency through automation & third-party integrations

With a digital KYC tool, your employees don’t have to spend time on manual data entry, PEP/sanctions checks, and beneficial owner identification. All these processes will be automatically carried out by the system.

Tools like Penneo KYC automatically retrieve beneficial ownership and client information from official business registers, carry out daily PEP and sanctions checks, and notify you of changes in your customers’ circumstances.

You can also leverage the integration capabilities of digital KYC software to import client data directly from your ERP system. This saves a lot of time on manual data entry and minimizes errors.

Improved compliance through audit logs, data centralization & guided risk assessment

Digital KYC also helps you improve compliance. The system asks you a series of pre-defined questions to help you assess the risk level of your customers. It also provides guidance on ML/TF risk factors according to national AML legislation.

All KYC data, including the risk assessment and the identity documents, are securely stored in the system and can easily be retrieved when needed. On top of that, all the steps performed during the KYC process are recorded in an audit log that you can use as proof of compliance.

With digital KYC verification, you can say goodbye to messy Excel spreadsheets and be fully prepared to demonstrate your compliance to the relevant authorities.

Data protection through end-to-end encryption

Far too many obliged entities still rely on insecure channels, such as email, to collect KYC data and documents from their clients. This is a big issue since KYC data is personal data, and the organizations that fail to protect it are in breach of the GDPR.

KYC verification software uses end-to-end encryption to ensure that all data and documents are securely collected and stored and that only the right people can access them.

Investing in a digital KYC tool helps obliged entities meet their GDPR compliance duties and prevent data breaches.

Enhanced client experience through digitalization

Delivering a superior customer experience is essential, regardless of whether you are a B2B or B2C company. Clients today expect their interactions with your business to be seamless and convenient.

With KYC verification software, client-facing processes run smoother than ever. The client receives the KYC request and can submit the necessary information and documents in just a few minutes. All they need is an Internet-connected device.

By reducing friction throughout the KYC process, obliged entities can provide a better experience to their clients and thus improve their competitiveness.

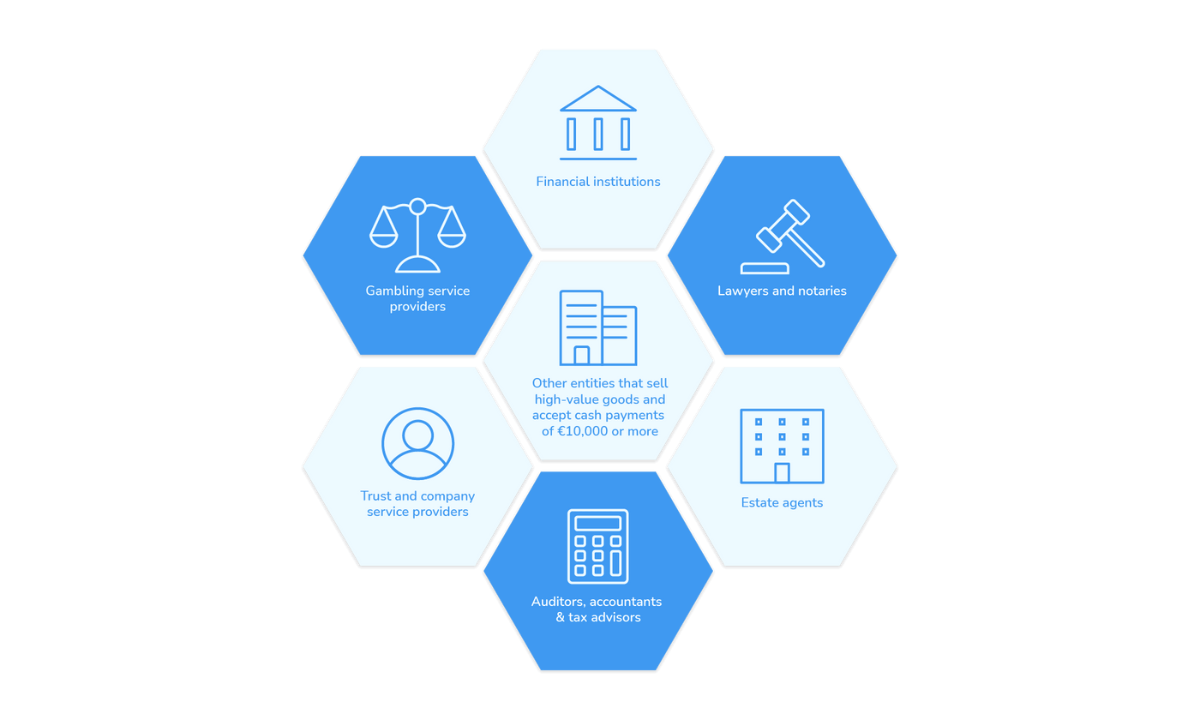

Who can benefit from digital KYC?

All obliged entities can benefit from digital KYC. KYC software can help auditors, accountants, tax advisors, real estate agents, lawyers, banks, leasing companies, and other businesses that must comply with AML laws to save time, cut costs, and strengthen data security.

KYC verification solution for EU-based companies

Penneo KYC is one of the leading KYC verification tools for companies based in the EU.

Over 600 obliged entities in Europe use Penneo KYC to automate customer due diligence and perform client risk assessments.

One of these companies is Complet Revision, an accounting firm based in Denmark. When Complet Revision received a visit from the Danish Business Authorities, the company was able to demonstrate its AML compliance with the help of Penneo KYC.

Penneo KYC helped us a lot during the inspection. We were able to show that we collected the right documentation from our clients and that we were storing it securely. Thanks to the audit log, we could also show when we collected the information and document each step of the process.

–- Louise Jansen, Auditor at Complet Revision

Do you want to find out how Penneo KYC can help your business?