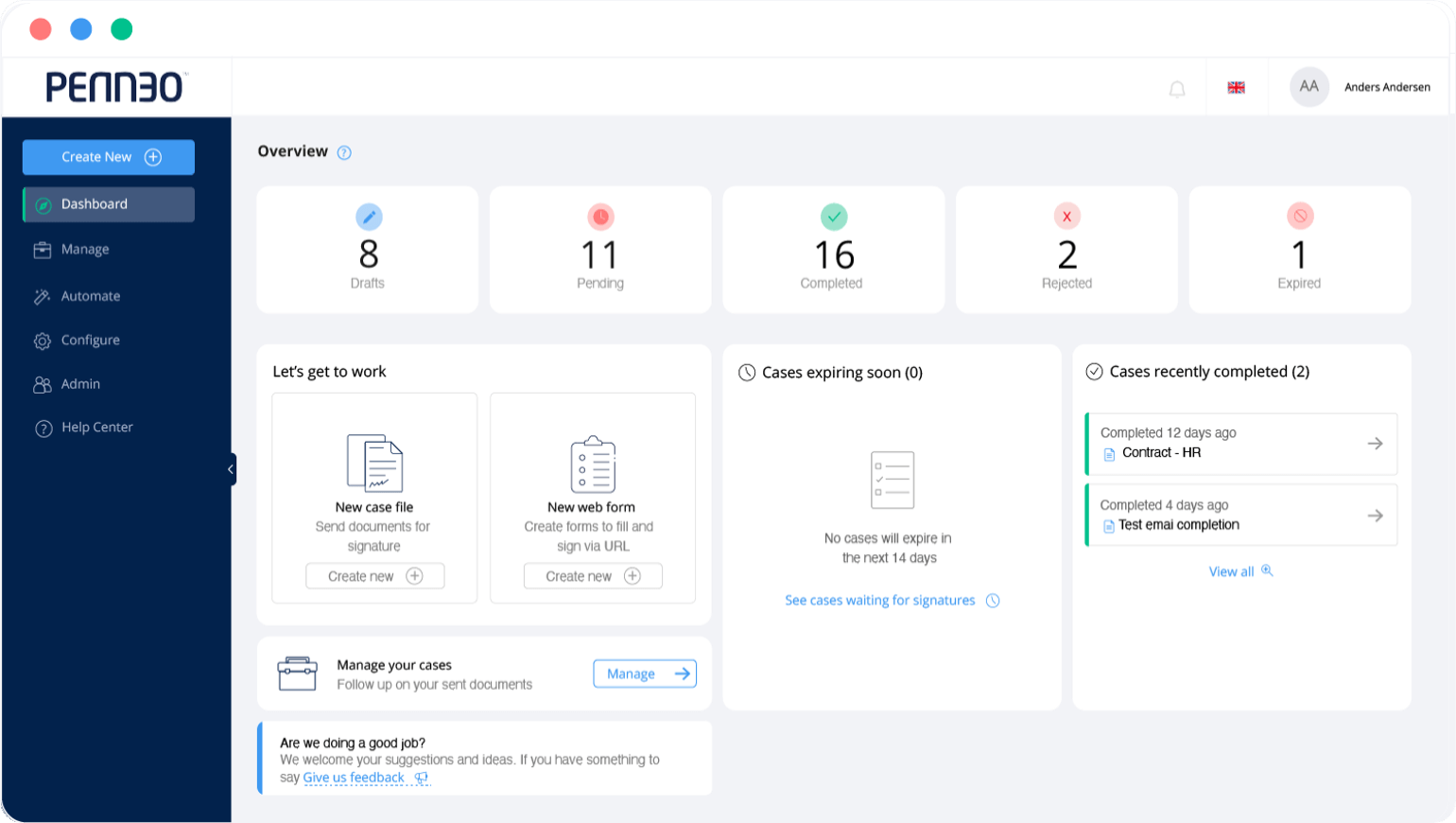

Free up time to focus on work that matters to you

Penneo gives you control over your document transactions and reduces the time you spend collecting signatures and fulfilling compliance requirements.

Automate your signing & document transactions

Over 60% of the documents sent with Penneo get back signed in less than 24h.

Facilitate great customer experience

Transform paper-based processes into a modern, digital customer journey.

Untangle regulatory compliant workflows

Customer onboarding is fully digital, guided, and KYC/AML compliant.

Spend your time on value-adding work. Automate the rest.

From onboarding new clients...

Don’t let time-consuming, manual onboarding processes slow you down when growing your business.

We make it easy and convenient to perform the KYC process digitally and live up to the AML requirements. With Penneo, you can take the compliance hassle out of the way, so you can get to work.

...to all the paperwork that comes with client collaborations...

Every business relationship involves a certain amount of paperwork. We know. It just has to be done.

But you can handle it in a smarter way. Signing documents digitally is faster, more secure, and convenient for everyone involved. No more spending time in the printing room.

...to growing together.

Business relationships evolve over time. Whether it’s having to update a client’s risk profile or collecting additional information — with Penneo, it’s easy to keep client relationships up to date.

We help you get rid of manual work and improve productivity, so you can focus on growing with your clients.

Don’t just take our word for it. Hear what our customers have to say.

And did we mention we take security and compliance very seriously?

KYC & AML compliance

Encrypted data handling

eIDAS compliant digital signatures

ISAE 3000 certified

Discover the benefits for your industry