Bookkeepers, auditors, accountants, lawyers, tax advisors, consultants, and other professionals must draft engagement letters and send them to their clients for signature before the start of the engagement.

The traditional process of getting the engagement letter signed usually involves a lot of manual work and can be very time-consuming. The auditor sends the engagement letter to the client by email. Once the client receives the letter they need to print it, sign it by hand, scan it, and email it back to the auditor. This way of doing things is slow, inefficient, and requires a lot of effort on the client’s part.

Luckily, advancements in technology make it possible to simplify this process by allowing you and your clients to send and sign engagement letters digitally with the help of a digital signature solution.

This article is aimed at business professionals who want to reap the benefits of digital signature software and start signing engagement letters digitally.

Is it legal to sign engagement letters digitally?

Yes, it is legal to use a digital signature to sign engagement letters. According to the EU’s eIDAS regulation, digitally signed documents are legally binding and admissible as evidence in a court of law.

What are the benefits of signing engagement letters digitally?

There are many benefits to signing engagement letters digitally, including increased security and higher efficiency.

Increased security

Digital signature solutions provide security features, such as access control and encryption to ensure that your documents cannot be accessed by unauthorised third-parties. Plus, they store all data and documents in compliance with the GDPR.

Thanks to the regular data backups performed by digital signature solutions, you can always recover your data and documents in the event of a disruption.

Legally binding engagement letters

All engagement letters signed using an advanced or qualified electronic signature are legally binding. This is because these types of e-signatures can identify the signers and guarantee the integrity of the signed engagement letter.

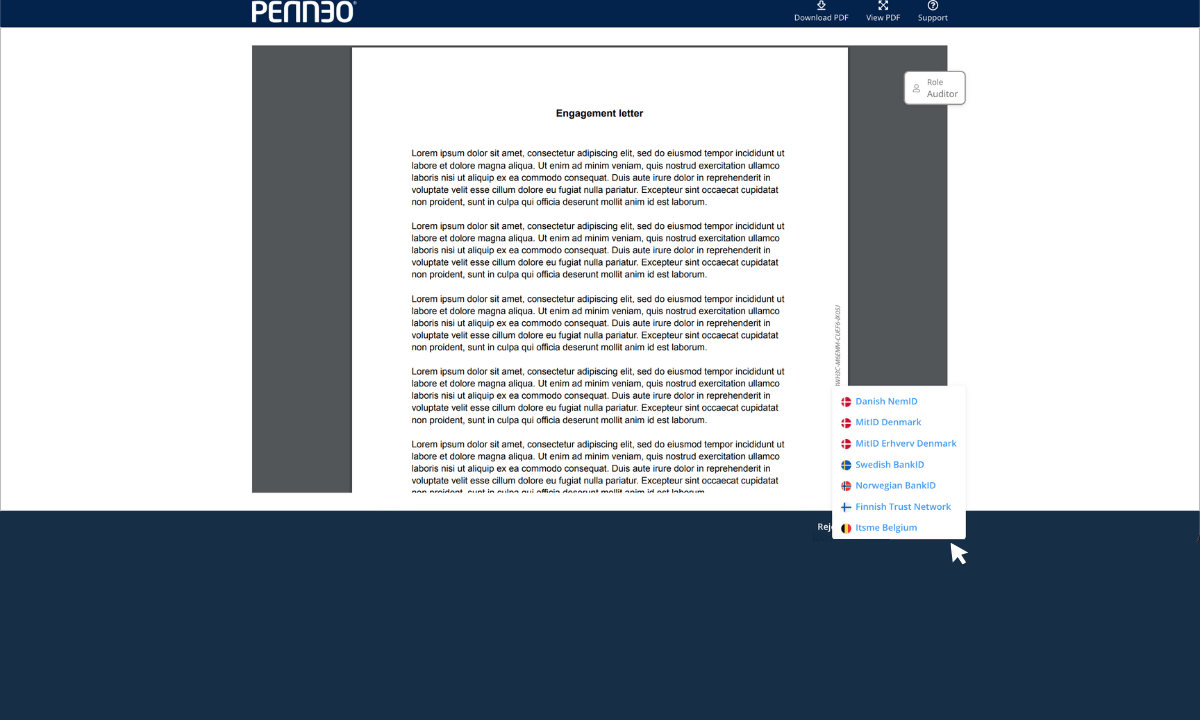

The best digital signature solutions on the market enable you and your clients to create advanced or/and qualified electronic signatures using an eID, such as itsme®, MitID, Swedish BankID, Norwegian BankID, or Mobiilivarmenne.

Higher efficiency

Thanks to features like automated document routing, digital signing, and automated reminders, you reduce manual work, cut printing and postage costs, and get engagement letters signed faster.

For maximum efficiency, you can integrate the digital signature solution with your other software to automate your processes from start to finish.

Better client experience

Digital signature software allows your clients to sign the engagement letter digitally from anywhere and from any device without having to worry about printing, scanning, and mailing it. This makes the process far more convenient and contributes positively to the customer experience.

How can I send an engagement letter for digital signature?

The first step to sending an engagement letter for digital signature is to implement a digital signature tool. There are many options for digital signature systems, but you’ll have to choose one that provides the compliance and security features that your organisation needs.

Different signature solutions work differently. Therefore, in this article, we have decided to illustrate the process of sending an engagement letter for digital signature via Penneo Sign.

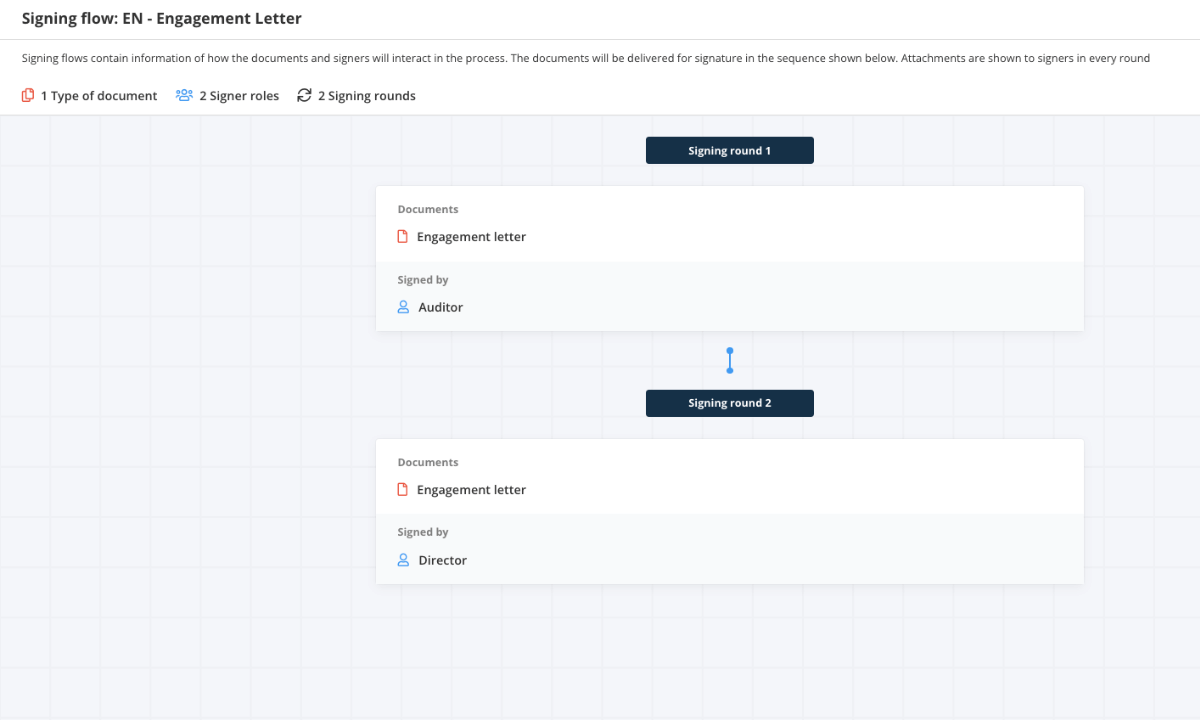

- Step 1: Create an appropriate signing flow. The signing flow ensures that a specific document type, in this case, the engagement letter, is sent to and signed by the right people in the right order.

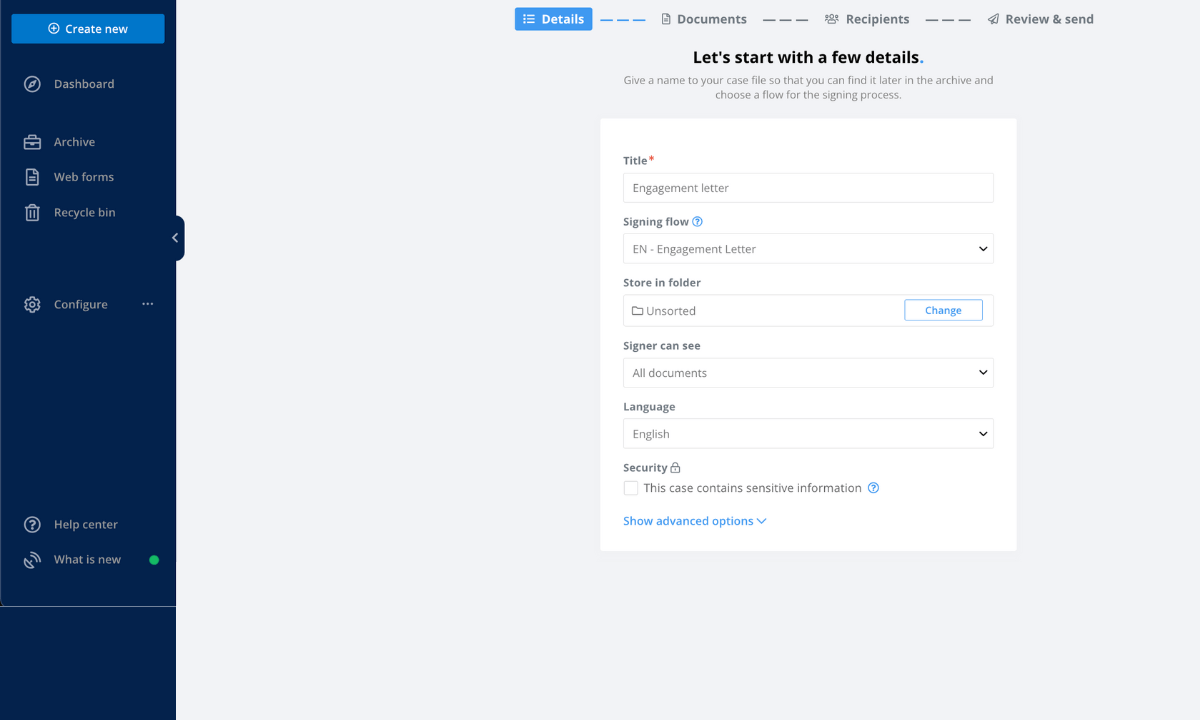

- Step 2: Create a new casefile, upload the engagement letter, and choose the signing flow that you created for engagement letters.

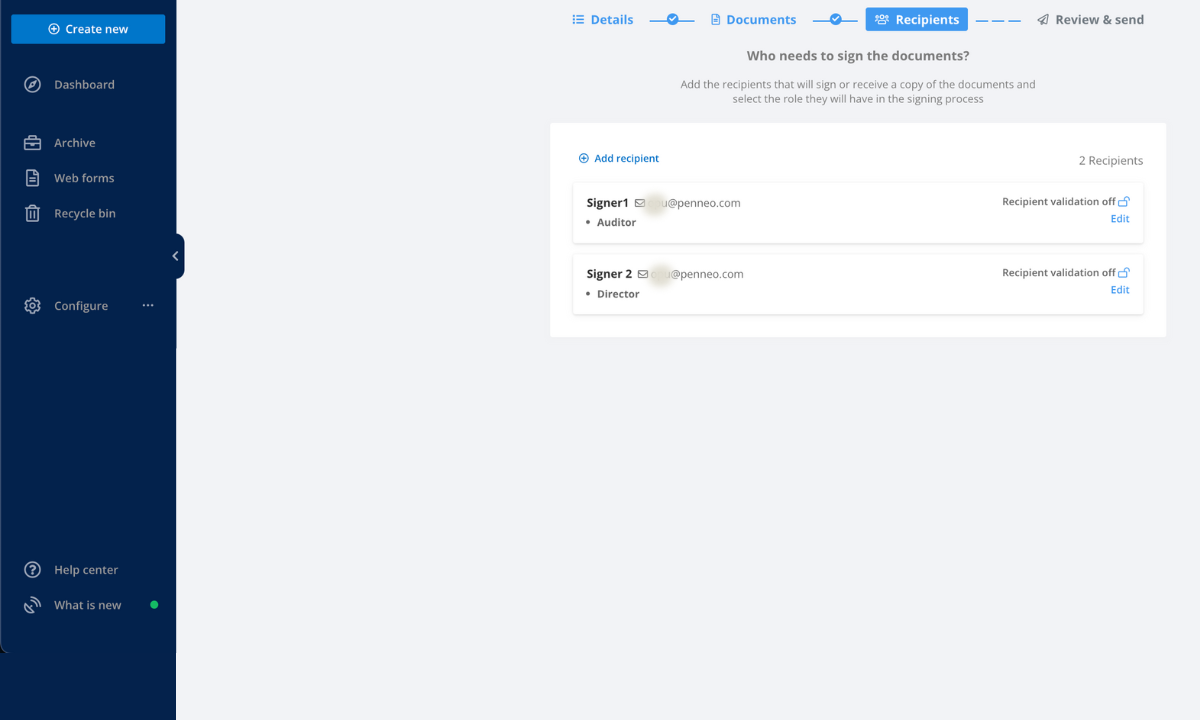

- Step 3: Add the recipients and their signing roles. To ensure that the engagement letter is signed by the right people in the right order, make sure that the signing roles match the ones in your signing flow.

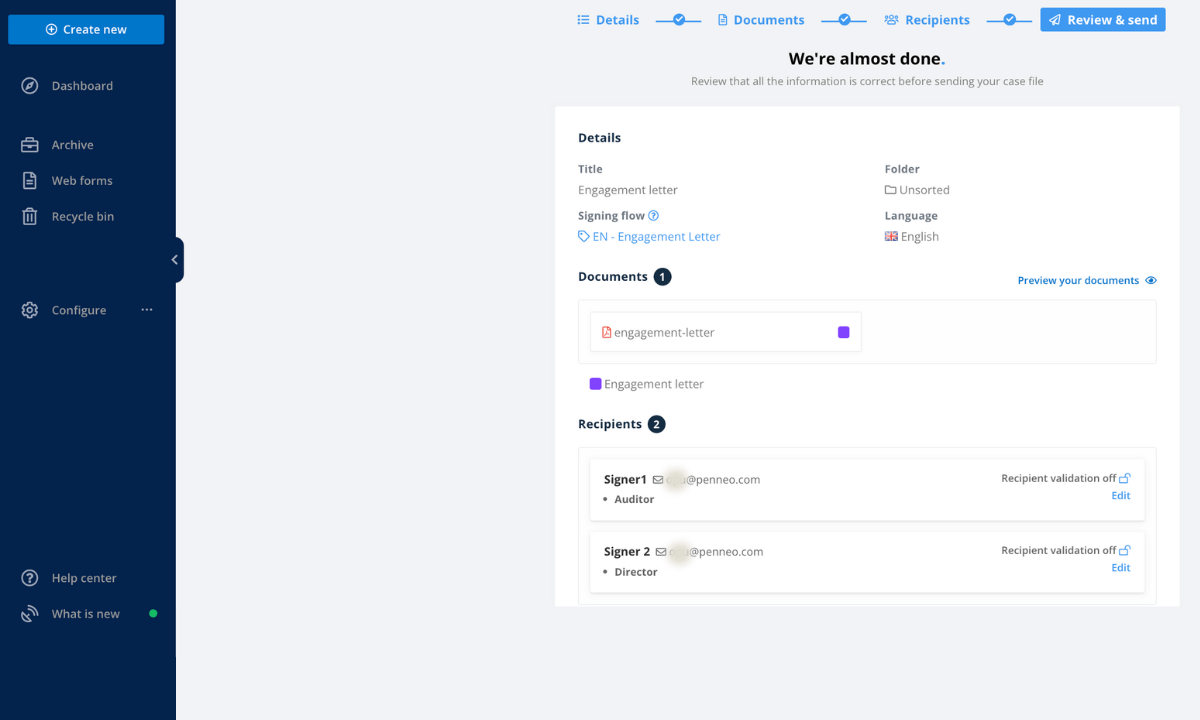

- Step 4: Check that all the details are correct and send the engagement letter to the intended recipients.

How can the recipients sign the engagement letter digitally?

Here we will explain how the recipients can sign the engagement letter digitally via Penneo Sign.

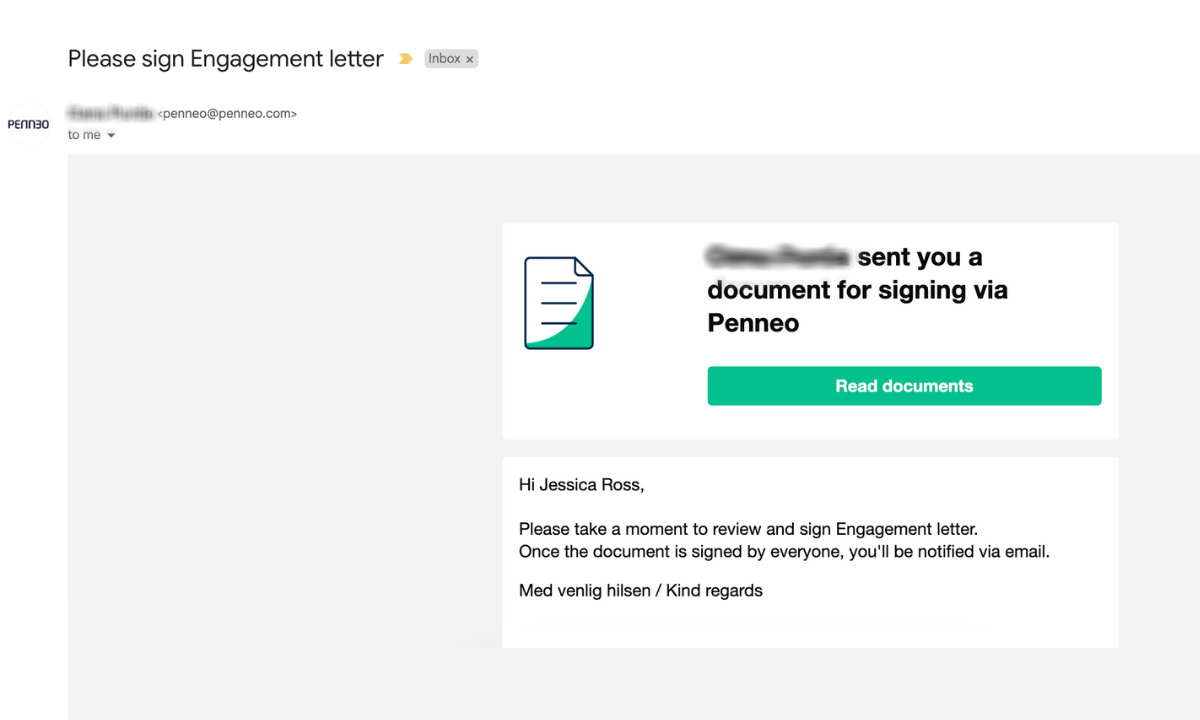

- Step 1: The director of the client will receive the engagement letter first. They must open the email from Penneo and click on the “Read documents” button.

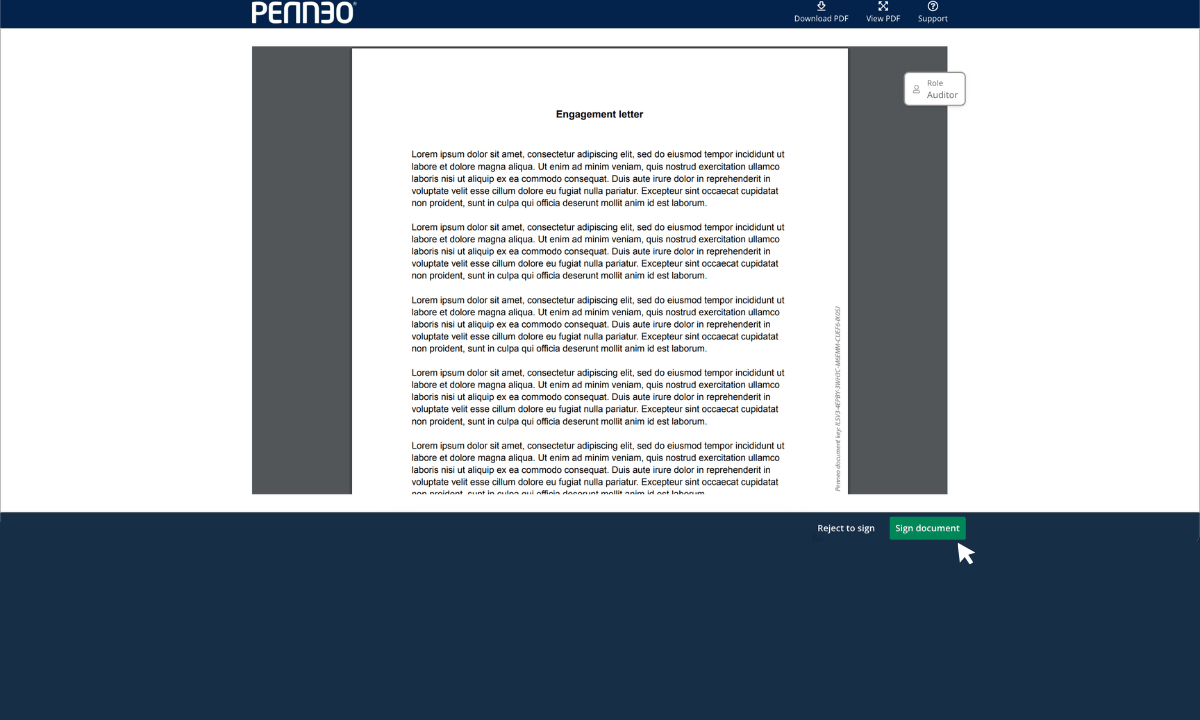

- Step 2: They will be taken to the engagement letter and asked to read its content. Once they finish reading the letter, they must click on the “Sign document” button.

- Step 3: The recipients must authenticate themselves using their electronic ID. Recipients who don’t have an electronic ID, can also sign with a simple electronic signature (e.g., draw or type the signature).

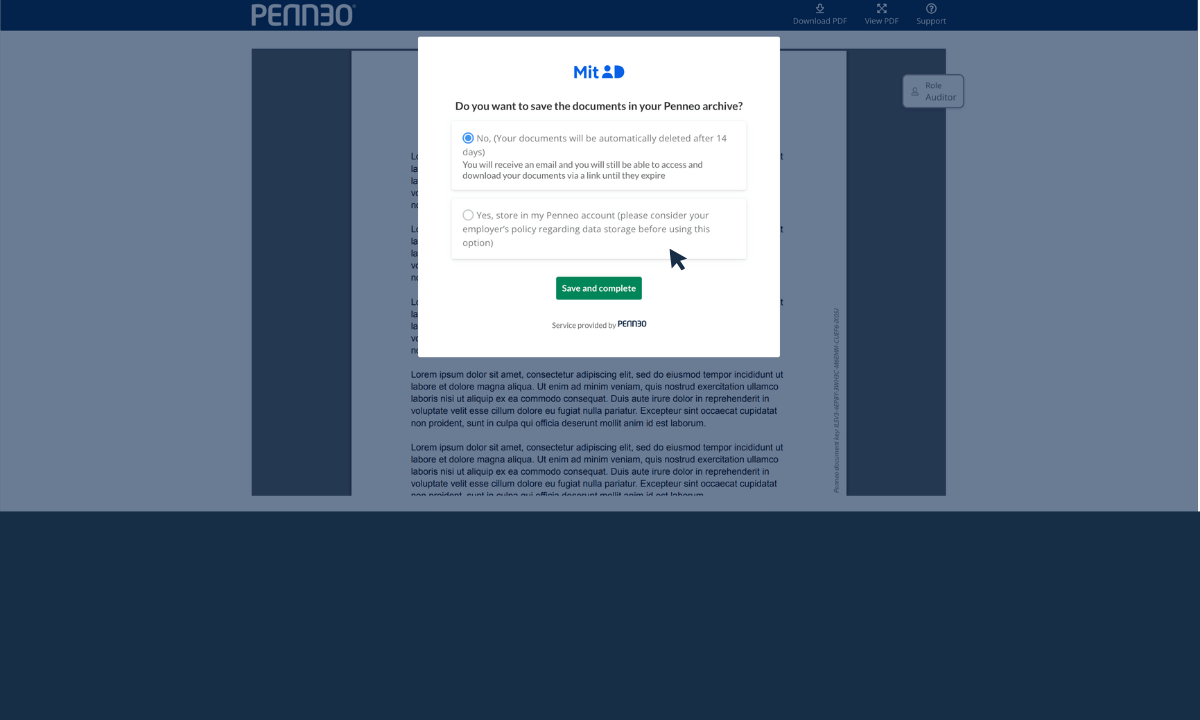

- Step 4: Once the authentication process is complete, the engagement letter is signed and automatically returned to the auditor who can now sign it too. The client can also choose to save the signed engagement letter in their free personal Penneo archive.

How can Penneo Sign help you?

Penneo Sign enables you to automate your signature processes and get engagement letters signed in a matter of hours instead of days. This means you and your colleagues can work more efficiently and provide more value to your clients.

Furthermore, our eID signatures meet the security requirement laid out in the eIDAS regulation, so you can rest assured that all engagement letters signed via Penneo Sign are legally binding.

Want to see how it works in practice? Try Penneo Sign for free or book a meeting with one of our experts to discuss how we can help your business succeed.